Nonbank Lending and Credit Cyclicality

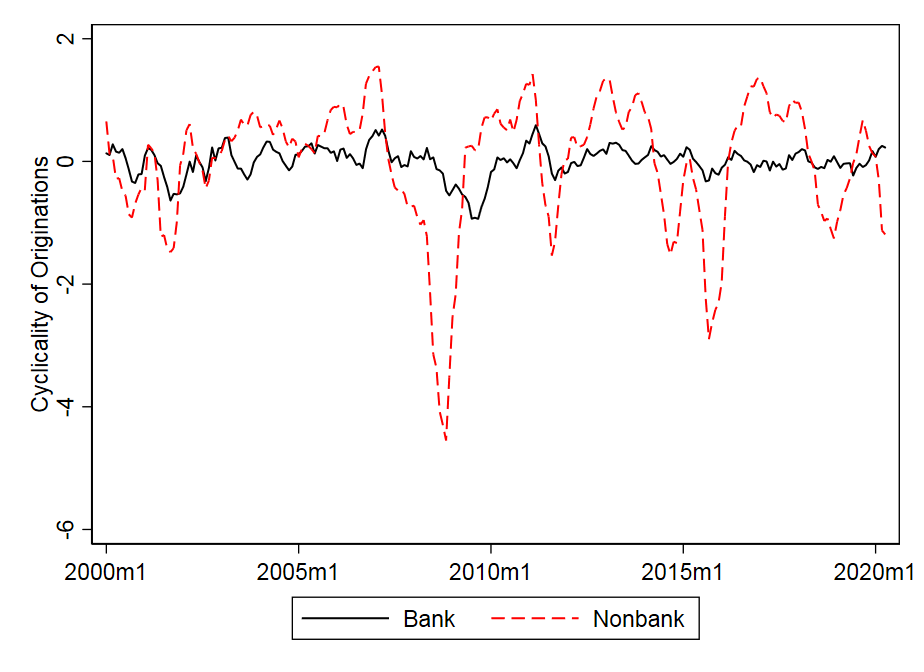

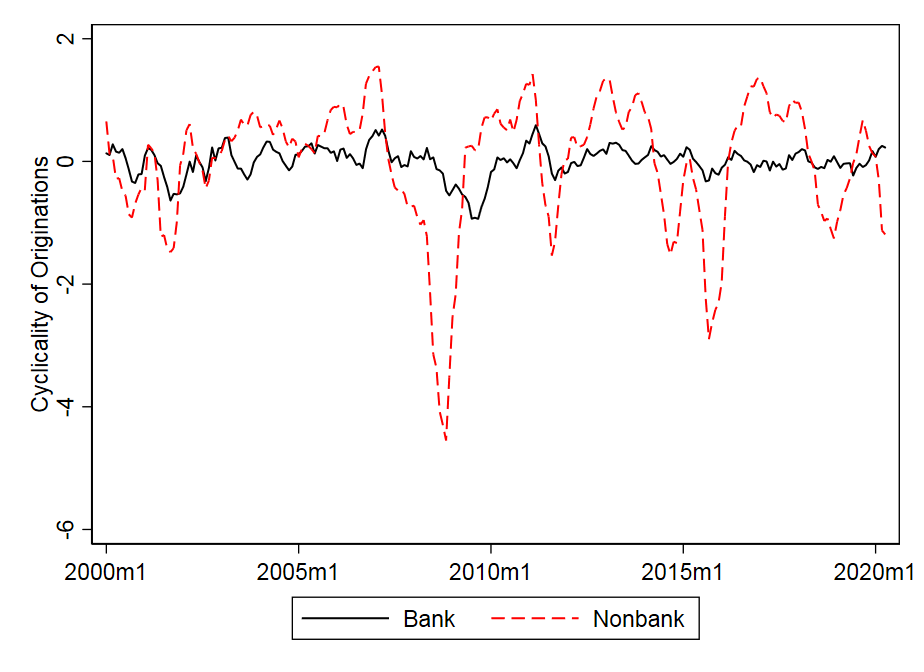

Prior work identifies bank health as a key driver of syndicated lending fluctuations, particularly during the Global Financial Crisis. We show that the relationship between bank health and lending weakens considerably once we account for the impact of nonbanks on loan originations. Weaker banks originated more nonbank loans pre-crisis and reduced their originations more during the crisis, as nonbanks withdrew. Comparing banks and nonbanks over multiple credit cycles, we find that the cyclicality of nonbanks’ credit supply is more than three times higher. We show - empirically and theoretically - that theories of heterogeneous financial frictions can explain the evidence. Download Paper Here

Prior work identifies bank health as a key driver of syndicated lending fluctuations, particularly during the Global Financial Crisis. We show that the relationship between bank health and lending weakens considerably once we account for the impact of nonbanks on loan originations. Weaker banks originated more nonbank loans pre-crisis and reduced their originations more during the crisis, as nonbanks withdrew. Comparing banks and nonbanks over multiple credit cycles, we find that the cyclicality of nonbanks’ credit supply is more than three times higher. We show - empirically and theoretically - that theories of heterogeneous financial frictions can explain the evidence. Download Paper Here Prior work identifies bank health as a key driver of syndicated lending fluctuations, particularly during the Global Financial Crisis. We show that the relationship between bank health and lending weakens considerably once we account for the impact of nonbanks on loan originations. Weaker banks originated more nonbank loans pre-crisis and reduced their originations more during the crisis, as nonbanks withdrew. Comparing banks and nonbanks over multiple credit cycles, we find that the cyclicality of nonbanks’ credit supply is more than three times higher. We show - empirically and theoretically - that theories of heterogeneous financial frictions can explain the evidence. Download Paper Here

Prior work identifies bank health as a key driver of syndicated lending fluctuations, particularly during the Global Financial Crisis. We show that the relationship between bank health and lending weakens considerably once we account for the impact of nonbanks on loan originations. Weaker banks originated more nonbank loans pre-crisis and reduced their originations more during the crisis, as nonbanks withdrew. Comparing banks and nonbanks over multiple credit cycles, we find that the cyclicality of nonbanks’ credit supply is more than three times higher. We show - empirically and theoretically - that theories of heterogeneous financial frictions can explain the evidence. Download Paper Here.jpg)