The Rise of Finance Companies and FinTech Lenders in Small Business Lending

Review of Financial Studies, Editor's Choice

Coauthors: Philipp Schnabl

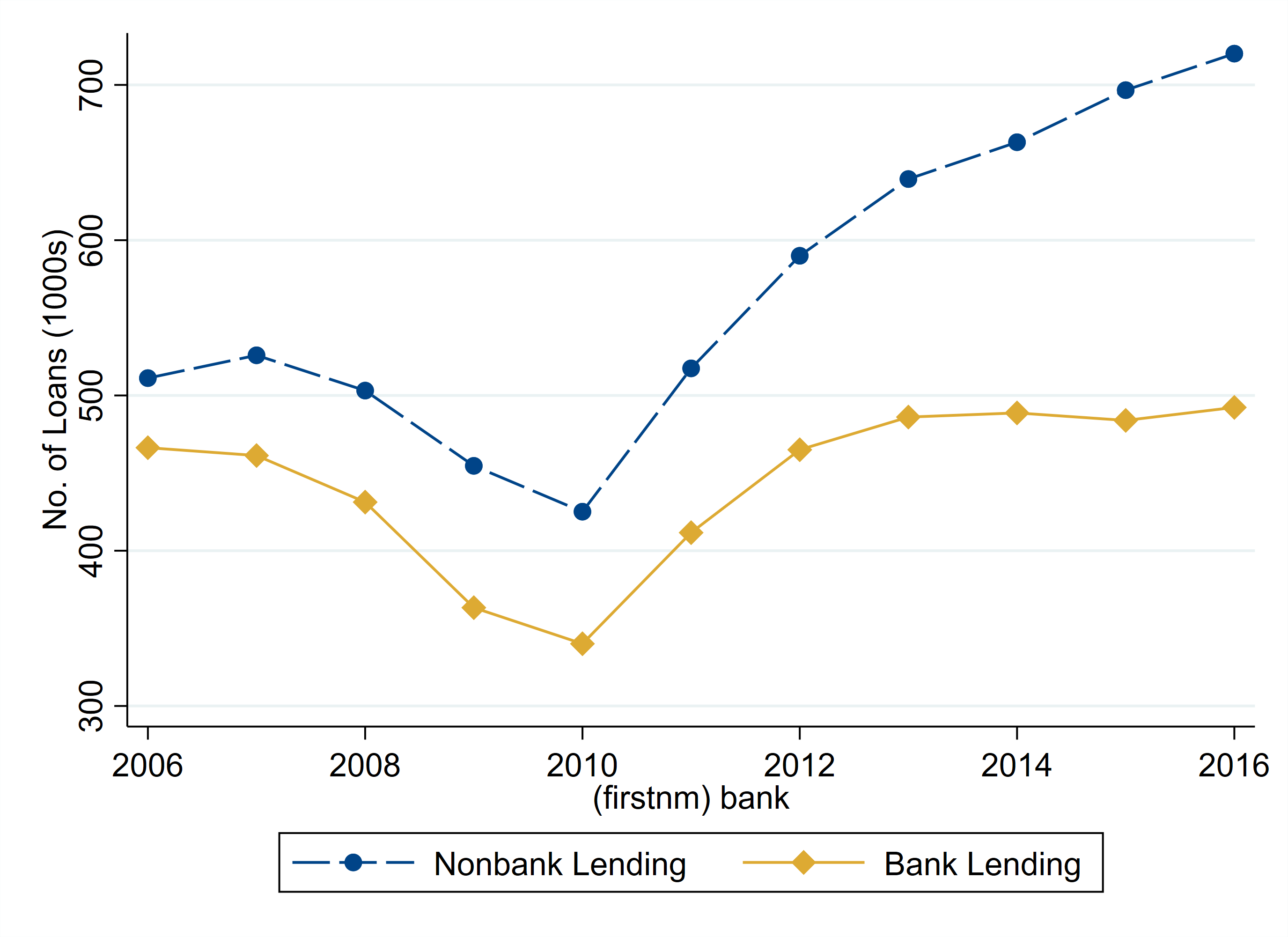

We document that finance companies and FinTech Lenders increased lending to small businesses after the 2008 financial crisis. We show that most of the increase substituted for a reduction in lending by banks. In counties where banks had a larger market share before the crisis, finance companies and FinTech lenders increased their lending more. By 2016, the increase in finance company and FinTech lending almost perfectly offset the decrease in bank lending. We control for firms’ credit demand by examining lending by different lenders to the same firm, by comparing firms within the same narrow industry, and by comparing firms pledging the same collateral. Consistent with the substitution of bank lending with finance company and FinTech lending, we find limited long-term effects on employment, wages, new business creation, and business expansion. Our results show that finance companies and FinTech lenders are major suppliers of credit to small businesses and played an important role in the recovery from the 2008 financial crisis.

We document that finance companies and FinTech Lenders increased lending to small businesses after the 2008 financial crisis. We show that most of the increase substituted for a reduction in lending by banks. In counties where banks had a larger market share before the crisis, finance companies and FinTech lenders increased their lending more. By 2016, the increase in finance company and FinTech lending almost perfectly offset the decrease in bank lending. We control for firms’ credit demand by examining lending by different lenders to the same firm, by comparing firms within the same narrow industry, and by comparing firms pledging the same collateral. Consistent with the substitution of bank lending with finance company and FinTech lending, we find limited long-term effects on employment, wages, new business creation, and business expansion. Our results show that finance companies and FinTech lenders are major suppliers of credit to small businesses and played an important role in the recovery from the 2008 financial crisis.

Presentations (including scheduled and co-author presentations): AFA(2021), Nova SBE FinTech Conference, Swiss Winter Finance Conference on Financial Intermediation, Financial Intermediation Research Society (FIRS), Central Bank Research Association (CEBRA) Annual Meeting, European Finance Association (EFA), University of Missouri, Federal Reserve Board of Governors, Rutgers University, UIUC, UT Dallas, Kellogg School of Management, FDIC/ JFSR Bank Research Conference, Frankfurt School of Finance and Management, Central Bank of Ireland (scheduled), Fintech: Innovation, Inclusion, and Risks Conference 2022 (scheduled), Chicago Booth Symposium on Private Firms (scheduled), Western Finance Association (2022)

Slides: Download here

Data/Code: Download here

.jpg)

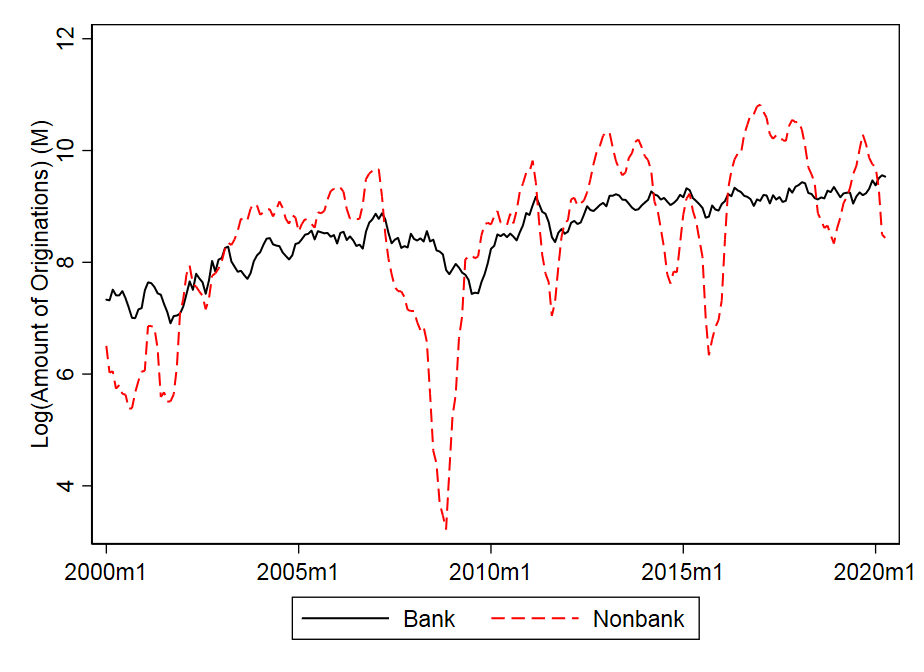

Prior work identifies bank health as a key driver of syndicated lending fluctuations, particularly during the Global Financial Crisis. We show that the relationship between bank health and lending weakens considerably once we account for the impact of nonbanks on loan originations. Weaker banks originated more nonbank loans pre-crisis and reduced their originations more during the crisis, as nonbanks withdrew. Comparing banks and nonbanks over multiple credit cycles, we find that the cyclicality of nonbanks’ credit supply is more than three times higher. We show - empirically and theoretically - that theories of heterogeneous financial frictions can explain the evidence.

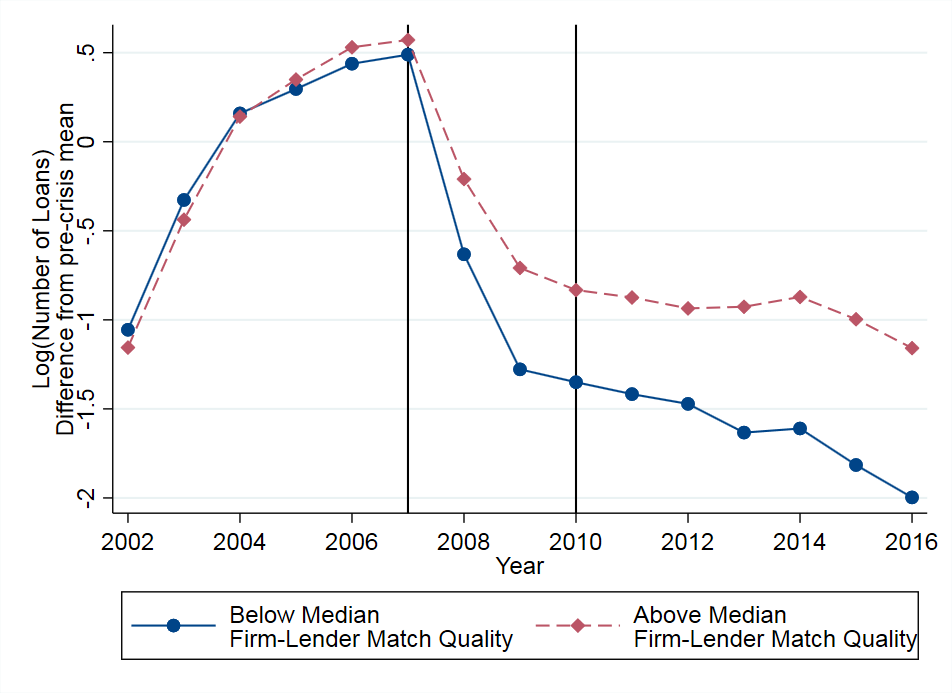

Prior work identifies bank health as a key driver of syndicated lending fluctuations, particularly during the Global Financial Crisis. We show that the relationship between bank health and lending weakens considerably once we account for the impact of nonbanks on loan originations. Weaker banks originated more nonbank loans pre-crisis and reduced their originations more during the crisis, as nonbanks withdrew. Comparing banks and nonbanks over multiple credit cycles, we find that the cyclicality of nonbanks’ credit supply is more than three times higher. We show - empirically and theoretically - that theories of heterogeneous financial frictions can explain the evidence. I study the role of collateral on small business credit access in the aftermath of the 2008 financial crisis. I construct a novel, loan-level dataset covering all collateralized small business lending in Texas from 2002-2016 and link it to the U.S. Census of Establishments. Using textual analysis, I quantify whether a lender is specialized in a borrower’s collateral by comparing the collateral pledged by the borrower to the lender’s collateral portfolio. I show that post-2008, lenders reduced credit supply by focusing on borrowers that pledged collateral in which the lender specialized. This result holds when comparing lending to the same borrower from different lenders, and when comparing lending by the same lender to different borrowers. A one standard deviation higher specialization in collateral increases lending to the same firm by 3.7%. Abstracting from general equilibrium effects, if firms switched to lenders with the highest specialization in their collateral, aggregate lending would increase by 14.8%. Furthermore, firms borrowing from lenders with greater specialization in the borrower’s collateral see a larger growth in employment after 2008. I identify the lender’s informational advantage in the posted collateral to be the mechanism driving lender specialization. Finally, I show that firms with collateral more frequently accepted by lenders in the economy find it easier to switch lenders. In sum, my paper shows that borrowing from specialized lenders increases access to credit and employment during a financial crisis.

I study the role of collateral on small business credit access in the aftermath of the 2008 financial crisis. I construct a novel, loan-level dataset covering all collateralized small business lending in Texas from 2002-2016 and link it to the U.S. Census of Establishments. Using textual analysis, I quantify whether a lender is specialized in a borrower’s collateral by comparing the collateral pledged by the borrower to the lender’s collateral portfolio. I show that post-2008, lenders reduced credit supply by focusing on borrowers that pledged collateral in which the lender specialized. This result holds when comparing lending to the same borrower from different lenders, and when comparing lending by the same lender to different borrowers. A one standard deviation higher specialization in collateral increases lending to the same firm by 3.7%. Abstracting from general equilibrium effects, if firms switched to lenders with the highest specialization in their collateral, aggregate lending would increase by 14.8%. Furthermore, firms borrowing from lenders with greater specialization in the borrower’s collateral see a larger growth in employment after 2008. I identify the lender’s informational advantage in the posted collateral to be the mechanism driving lender specialization. Finally, I show that firms with collateral more frequently accepted by lenders in the economy find it easier to switch lenders. In sum, my paper shows that borrowing from specialized lenders increases access to credit and employment during a financial crisis.