The Rise of Finance Companies and FinTech Lenders in Small Business Lending

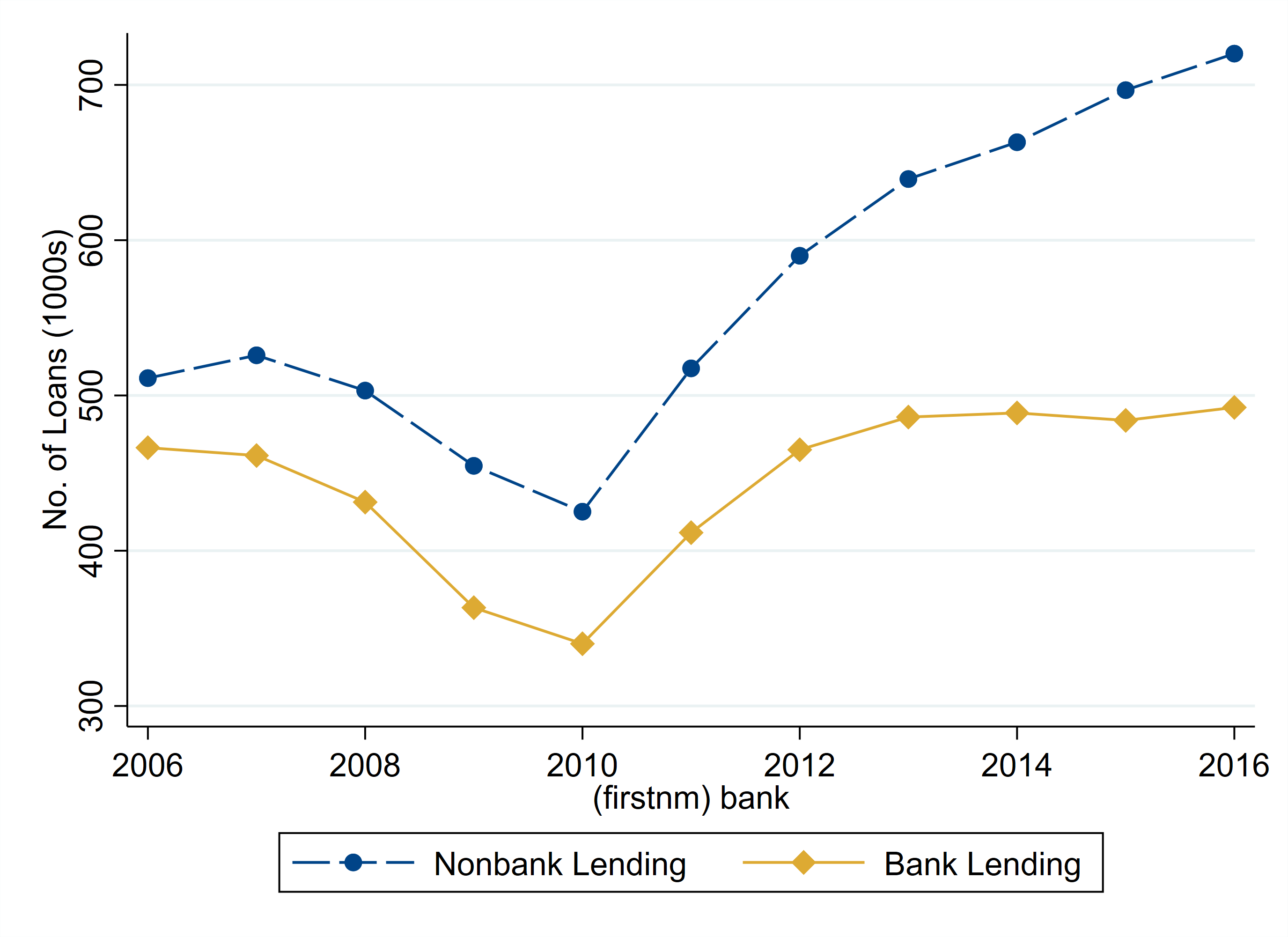

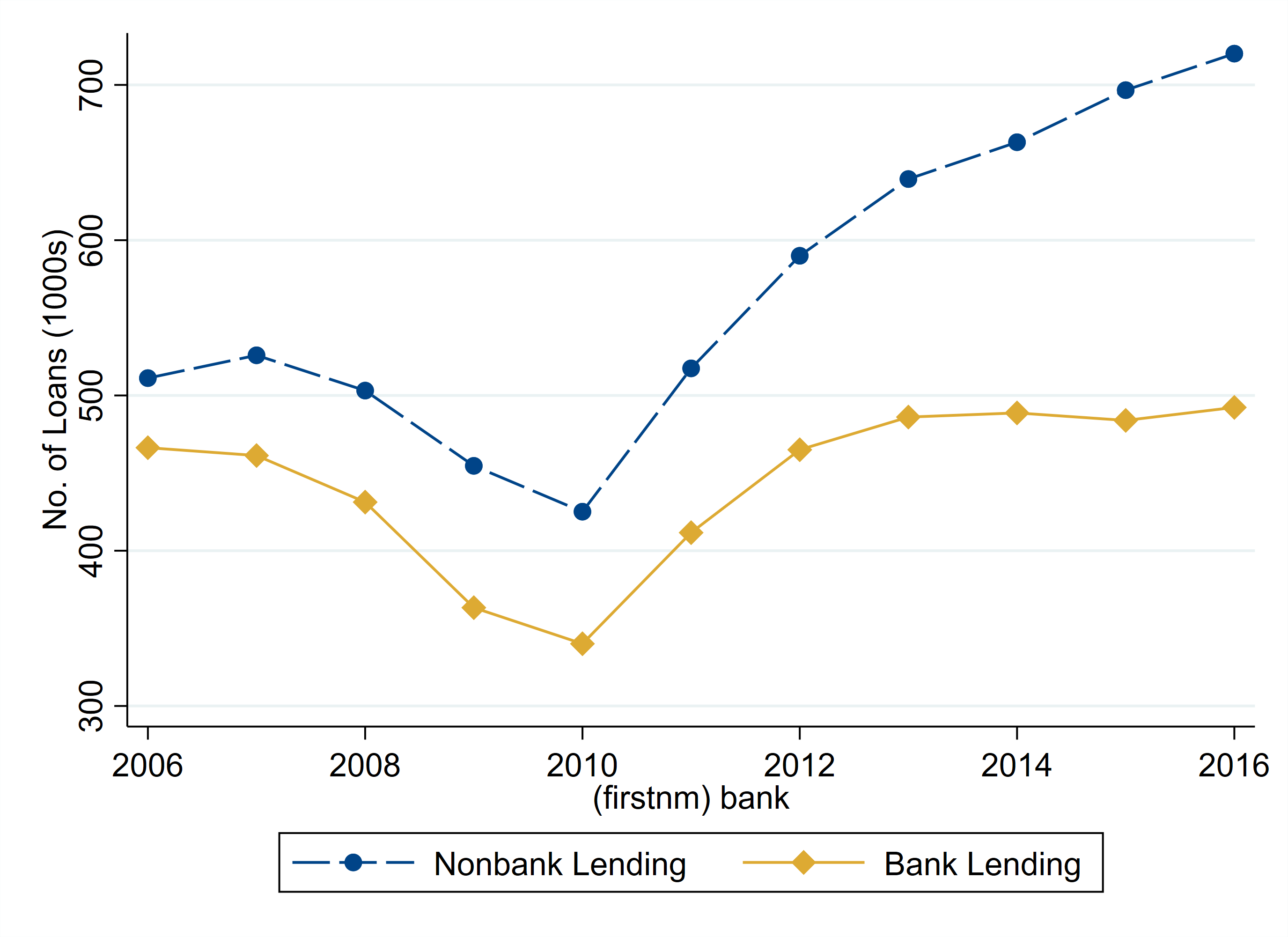

We document that finance companies and FinTech lenders increased lending to small businesses after the 2008 financial crisis. We show that most of the increase substituted for a reduction in lending by banks. In counties where banks had a larger market share before the crisis, finance companies and FinTech lenders increased their lending more. By 2016, the increase in finance company and FinTech lending almost perfectly offset the decrease in bank lending. We control for firms' credit demand by examining lending by different lenders to the same firm, by comparing firms within the same narrow industry, and by comparing firms pledging the same type of collateral. Consistent with the substitution of bank lending with finance company and FinTech lending, we find that reduced bank lending had no effect on employment, wages, new business creation, or business expansion. Our results show that finance companies and FinTech lenders are major suppliers of credit to small businesses and played an important role in the recovery from the 2008 financial crisis. Download Paper Here

We document that finance companies and FinTech lenders increased lending to small businesses after the 2008 financial crisis. We show that most of the increase substituted for a reduction in lending by banks. In counties where banks had a larger market share before the crisis, finance companies and FinTech lenders increased their lending more. By 2016, the increase in finance company and FinTech lending almost perfectly offset the decrease in bank lending. We control for firms' credit demand by examining lending by different lenders to the same firm, by comparing firms within the same narrow industry, and by comparing firms pledging the same type of collateral. Consistent with the substitution of bank lending with finance company and FinTech lending, we find that reduced bank lending had no effect on employment, wages, new business creation, or business expansion. Our results show that finance companies and FinTech lenders are major suppliers of credit to small businesses and played an important role in the recovery from the 2008 financial crisis. Download Paper Here We document that finance companies and FinTech lenders increased lending to small businesses after the 2008 financial crisis. We show that most of the increase substituted for a reduction in lending by banks. In counties where banks had a larger market share before the crisis, finance companies and FinTech lenders increased their lending more. By 2016, the increase in finance company and FinTech lending almost perfectly offset the decrease in bank lending. We control for firms' credit demand by examining lending by different lenders to the same firm, by comparing firms within the same narrow industry, and by comparing firms pledging the same type of collateral. Consistent with the substitution of bank lending with finance company and FinTech lending, we find that reduced bank lending had no effect on employment, wages, new business creation, or business expansion. Our results show that finance companies and FinTech lenders are major suppliers of credit to small businesses and played an important role in the recovery from the 2008 financial crisis. Download Paper Here

We document that finance companies and FinTech lenders increased lending to small businesses after the 2008 financial crisis. We show that most of the increase substituted for a reduction in lending by banks. In counties where banks had a larger market share before the crisis, finance companies and FinTech lenders increased their lending more. By 2016, the increase in finance company and FinTech lending almost perfectly offset the decrease in bank lending. We control for firms' credit demand by examining lending by different lenders to the same firm, by comparing firms within the same narrow industry, and by comparing firms pledging the same type of collateral. Consistent with the substitution of bank lending with finance company and FinTech lending, we find that reduced bank lending had no effect on employment, wages, new business creation, or business expansion. Our results show that finance companies and FinTech lenders are major suppliers of credit to small businesses and played an important role in the recovery from the 2008 financial crisis. Download Paper Here.jpg)